The Central Bank of Nigeria (CBN) has announced that it has released $500 million to various sectors in order to address the backlog of verified foreign exchange (FX) transactions.

This comes just a week after the bank paid $2.0 billion to settle outstanding commitments in the manufacturing, aviation, and petroleum sectors.

Hakama Sidi-Ali, the acting director of the corporate communications department at the CBN, spoke about the disbursement in Abuja on Monday. She stated that the CBN is committed to resolving all legitimate FX backlogs as quickly as possible.

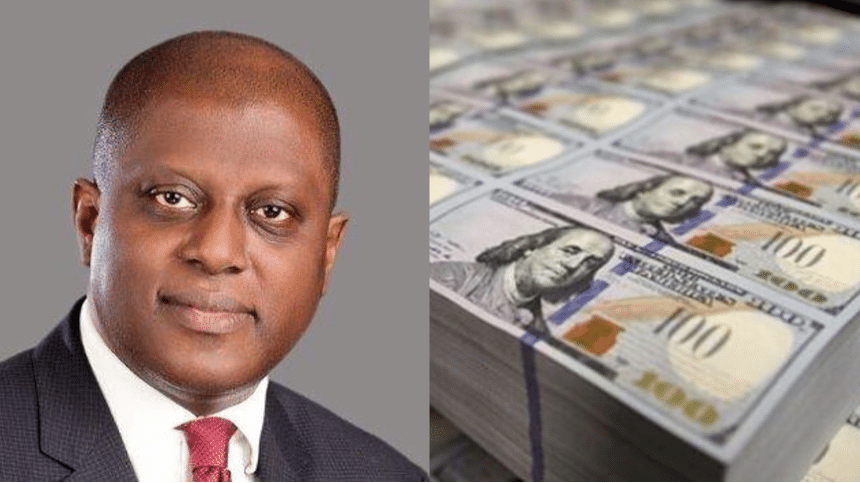

Ali also reiterated the assurances of Olayemi Cardoso, the governor of the CBN, that the apex bank has begun implementing a comprehensive strategy to improve liquidity in the Nigerian FX markets in the short, medium, and long term.

“As the Governor said, the CBN’s focus is on addressing fundamental issues that have hindered the effective operation of the Nigerian FX markets over the years,” she said.

Sidi-Ali mentioned that the FX reforms were created to simplify and standardize multiple exchange rates, increase transparency, and reduce the chances of taking advantage of price differences.

Ali also expressed optimism that a steady exchange rate would enhance investor confidence and attract foreign investment.

The spokesperson for the CBN urged all participants in the FX market to abide by the regulations.

Ali stated that transparency in the market would enable a fair determination of exchange rates, ensuring stability for both businesses and individuals.

In November 2023, the central bank began clearing the FX forwards backlog in banks. Additionally, on January 7, 2024, the bank distributed $61.64 million to foreign airlines through various deposit money banks (DMBs).