The Central Bank of Nigeria (CBN) alerted all authorized dealers and the general public on Wednesday of immediate changes to the Nigerian Foreign Exchange (FX) Market.

According to Angela Sere-Ejembi, Director of Financial Markets, “this will involve the unification of all segments of the forex market collapsing all previous windows into one.”

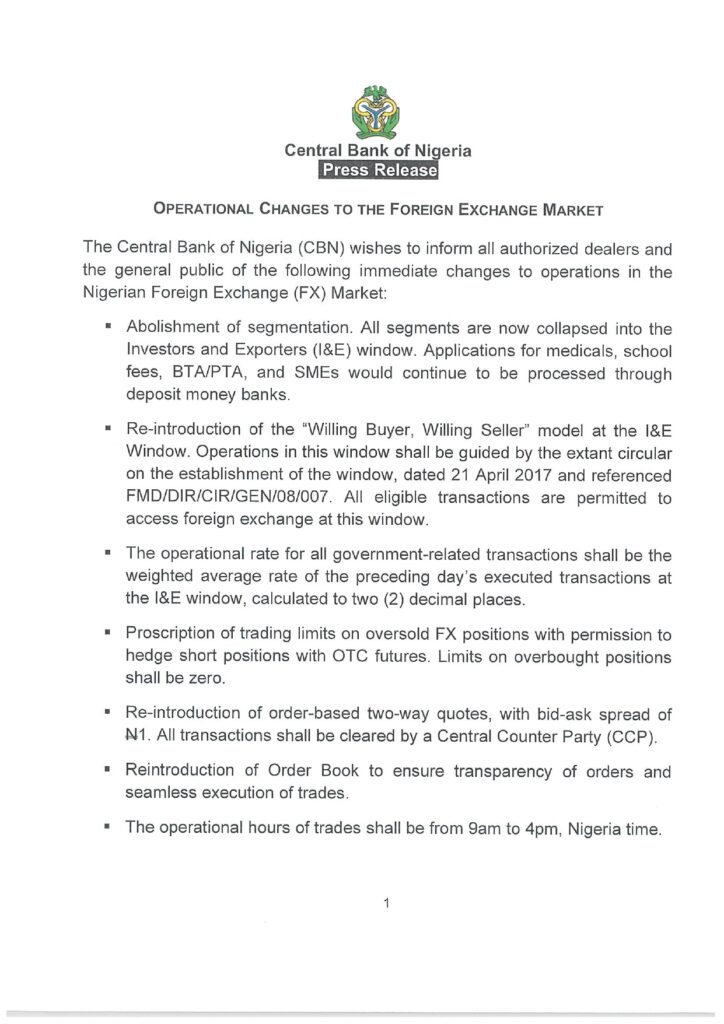

The changes include “abolishing the segmentation of the FX market into different windows. All transactions will now be done through the Investors and Exporters (I&E) window, Applications for medicals, school fees, BTA/PTA, and SMEs would continue to be processed through deposit money banks.”

With this collapse, applications for Business Travel Allowance and Personal Travel Allowance will be processed at the official exchange rate set by market forces at the I&E window.

According to the statement, the apex bank will be “reintroducing the ‘Willing Buyer, Willing Seller’ model at the I&E window, where all eligible transactions can access foreign exchange at their preferred rates.”

- Squeezing the Poor: The Silent Struggle of Nigeria’s Starving Souls

- Plates of Despair: Nigerian Women Battle Against Deepening Hunger

- Shadows of Hunger: Struggles of Nigeria’s Displaced Children Begging to Eat, Survive on the Streets – Part 2

- Shadows of Hunger: Struggles of Nigeria’s Displaced Children Begging to Eat, Survive on the Streets – Part 1

- ‘This Is Messing Up My Performance’ —Angry Rema Walks Off Stage Over Poor Sound In Atlanta

The CBN, on the other hand, will establish the operational rate for government transactions. This rate will be the weighted average of the preceding day’s I&E window transactions, rounded to two decimal places.

The currency price will follow a floating exchange rate paradigm as market forces emerge as significant determinants of exchange rates.

See the full statement below: