The presidential deadline for the recovery of Emefiele’s N1.1 Trillion loan expires today (September 18), and tensions are high because no one knows what the presidency’s next course of action will be.

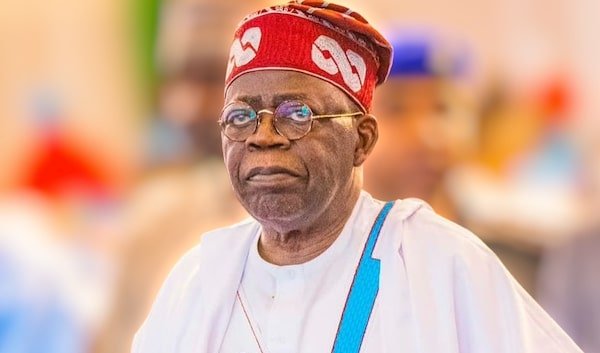

According to reports, the Jim Obazee-led special investigation panel appointed by President Bola Tinubu in July to investigate and reset the Central Bank of Nigeria (CBN) has expanded its net to include enterprises and facilities held by key officials at the apex bank, including board members.

Some of the companies, according to the Daily Sun, were utilized as conduits for anchor borrowers’ loans and foreign exchange rackets.

As a result, buddies of CBN top brass are panicking as investigators and security personnel round them up one by one for questioning.

Some genuine farmers who received a portion of the anchor borrowers’ facility but were unable to repay cited floods and shutdowns related to the COVID-19 outbreak as causes for default.

This is in addition to charges of financial misappropriation by CBN officials and other collaborating players who politicized a project supposed to address Nigerians’ food insecurity nightmare.

A source told the aforementioned publication:

“Let us get something clear. This is not a witch-hunt. It’s a call to service to restore the dignity of the apex bank, and we are leaving no stones unturned to do a thorough job. There are no sacred cows or sacrificial lambs.

“There are issues around anchor borrowers’ facilities. Billions of naira has been disbursed, but there are no rice paddies to repay. Where did the money go? What happened?

“There are also issues around foreign exchange round-tripping we are investigating. There is acute dollar scarcity. What really went wrong? Who are those responsible?

“So, as we dig in, if it concerns you, you will be invited. The DSS is also working with the panel. The goal is mutual.”

The fired CBN management facilitated the anchor borrowers’ loans totaling over N1.1 trillion; nevertheless, investigators think that little attempt was taken to recover the debt.

Only a little more than N546 billion of the N1.1 trillion disbursed by the CBN to ABP beneficiaries since its commencement has been refunded.

President Tinubu was irritated by the occurrence and has demanded that the due N577 billion be collected from defaulting farmers and CBN officials and their associates who reportedly transferred the cash to other private projects.